sftupak.ru

Market

Best Places Travel

Plan your next trip to one of the best places to vacation, including New York City, Paris, Orlando and Las Vegas. Whether you already know what travel destinations you'd like to visit or just want to discuss the options of where to go and when with one of our Destination. Las Vegas is great as a base for visiting other places. The Grand Canyon, Death Valley, LA, and Zion are all nearby. Plus there's good shows. Forbes Names St. Pete a 'Best Place to Travel' · 35 miles of pristine coastline with some of the country's top-ranked beaches · A vibrant arts and culture scene. World's Best Places to Visit · Paris · Bora Bora · Glacier National Park · Rome · Swiss Alps · Maui · London, England · Maldives · Turks & Caicos · Tokyo. We've compiled some of the best places to travel with friends, including the best beach vacations for a group of friends (sand and sun, anyone?). Best Places to travel in Lisbon, Portugal - Albuquerque, New Mexico - Alexandria, Virginia - Atlanta, Georgia - Barcelona, Spain - Cape Charles. From the changing oaks of the east coast of the USA to the wine festivals of Germany, autumn is truly one of our favorite seasons for travel. USA Travel Bucket List: 50 Places to Visit Before You Die · 1. New York City · 2. Grand Canyon, Arizona · 3. Disney World, Florida · 4. New Orleans, Louisiana · 5. Plan your next trip to one of the best places to vacation, including New York City, Paris, Orlando and Las Vegas. Whether you already know what travel destinations you'd like to visit or just want to discuss the options of where to go and when with one of our Destination. Las Vegas is great as a base for visiting other places. The Grand Canyon, Death Valley, LA, and Zion are all nearby. Plus there's good shows. Forbes Names St. Pete a 'Best Place to Travel' · 35 miles of pristine coastline with some of the country's top-ranked beaches · A vibrant arts and culture scene. World's Best Places to Visit · Paris · Bora Bora · Glacier National Park · Rome · Swiss Alps · Maui · London, England · Maldives · Turks & Caicos · Tokyo. We've compiled some of the best places to travel with friends, including the best beach vacations for a group of friends (sand and sun, anyone?). Best Places to travel in Lisbon, Portugal - Albuquerque, New Mexico - Alexandria, Virginia - Atlanta, Georgia - Barcelona, Spain - Cape Charles. From the changing oaks of the east coast of the USA to the wine festivals of Germany, autumn is truly one of our favorite seasons for travel. USA Travel Bucket List: 50 Places to Visit Before You Die · 1. New York City · 2. Grand Canyon, Arizona · 3. Disney World, Florida · 4. New Orleans, Louisiana · 5.

Best Places To Travel In November In The US · New York City: A Charming Urban Escape · San Francisco: A Blend of Culture and Nature · New. PLACES TO GO. Wyoming is a big state. It's nearly 98, square miles of By Travel Wyoming · Yellowstone's Best Geothermal Features. By Amelia Mayer. If you are a travel pro and dream to explore all the best places to visit in the World, Singapore should be on your cards. Unabashedly the most beautiful. Travel to the fjord village of Flåm with the Bergen Railway Line and the Flåm Railway Line, voted one of the world's most beautiful train journeys. For outdoor. Best of the Best Destinations · Dubai · Bali · London · Hanoi · Rome · Paris · Cancun · Marrakech. The top 10 countries, cities, regions, value destinations and sustainable spots around the world right now. Whether you already know what travel destinations you'd like to visit or just want to discuss the options of where to go and when with one of our Destination. We created this group for you to learn and share knowledge and tips of travelling to Italy. Discover the food, the people, places to stay and the best. Frommer's Best Places to Go in · We travelers seem to know this deep down, because our drive to wander also seems stronger than ever. A recent survey by. Places starting with A. Find countries & holiday destinations including popular cities We help you find the best travel deals for your holiday in the sun by. Get inspired with the best places to travel each month of the year! With 5+ destinations per month, you're sure to find the trip of your dreams. USA Travel Bucket List: 50 Places to Visit Before You Die · 1. New York City · 2. Grand Canyon, Arizona · 3. Disney World, Florida · 4. New Orleans, Louisiana · 5. Six amazing places to visit from the US in the Americas + the Caribbean · Turks + Caicos Islands · Costa Rica · Mexico · Belize · Panama · Nicaragua · Chat to. The jewel in the crown of the USA when it comes to urban areas, New York is a megacity that is absolutely packed full of iconic places, areas, and buildings. If you are a travel pro and dream to explore all the best places to visit in the World, Singapore should be on your cards. Unabashedly the most beautiful. Home Travel Travel Canada. 10 Places in Canada Every Canadian Needs to best places to visit in Canada. So plentiful are the bears that the town. Plan your next trip with our travel guides, where we select the best places to stay and things to do in popular destinations around the world. Travel Lemming reveals its much-anticipated annual picks for the 50 best places to travel in Hidden gems & hot emerging destinations. From a horseback safari in Kenya to river rafting in West Virginia, here's our ranked list of the top travel experiences right now. And it's just before holiday travel brings crowds. If you're after wildlife, November can be an ideal time to visit many of these places. For example, in Hawaii.

How To Buy Etf In Fidelity

What Are the Steps to Buy ETFs on Fidelity? · 1. Open a Fidelity account. · 2. Research ETFs. · 3. Determine your investment goals. · 4. Select the type of ETF. Fidelity Investments Canada ULC is one of Canada's top investment management firms managing a total of $ billion in mutual fund, ETF and institutional. Free commission offer applies to online purchase of ETFs in a Fidelity retail account. The sale of ETFs is subject to an activity assessment fee (from $ to. Exchange-traded funds (ETFs) can be a great investment vehicle for small and large investors alike. These popular funds, which are similar to mutual funds. trading normally. Any type of trade needs to be applied for and authorized pretty much. Many leveraged ETF's are not available. Pre-markets orders start. An exchange-traded fund (ETF) is a basket of securities you buy or sell through a brokerage firm on a stock exchange. When you buy or redeem a mutual fund, you are transacting directly with the fund, whereas with ETFs and stocks, you are trading on the secondary market. Unlike. Breadth of recurring transactions. Choose recurring investments in stocks, mutual funds, ETFs, and Fidelity Basket Portfolios directly from your Fidelity. ETF trading tips · 1. Pay attention to the bid-ask spread · 2. Consider limit orders · 3. Avoid trading around the market open and close. What Are the Steps to Buy ETFs on Fidelity? · 1. Open a Fidelity account. · 2. Research ETFs. · 3. Determine your investment goals. · 4. Select the type of ETF. Fidelity Investments Canada ULC is one of Canada's top investment management firms managing a total of $ billion in mutual fund, ETF and institutional. Free commission offer applies to online purchase of ETFs in a Fidelity retail account. The sale of ETFs is subject to an activity assessment fee (from $ to. Exchange-traded funds (ETFs) can be a great investment vehicle for small and large investors alike. These popular funds, which are similar to mutual funds. trading normally. Any type of trade needs to be applied for and authorized pretty much. Many leveraged ETF's are not available. Pre-markets orders start. An exchange-traded fund (ETF) is a basket of securities you buy or sell through a brokerage firm on a stock exchange. When you buy or redeem a mutual fund, you are transacting directly with the fund, whereas with ETFs and stocks, you are trading on the secondary market. Unlike. Breadth of recurring transactions. Choose recurring investments in stocks, mutual funds, ETFs, and Fidelity Basket Portfolios directly from your Fidelity. ETF trading tips · 1. Pay attention to the bid-ask spread · 2. Consider limit orders · 3. Avoid trading around the market open and close.

Fidelity Investments. At Fidelity, you can start with as little as $1 when you buy fractional shares of iShares ETFs. · Online Brokerage Account. Buy iShares. An investor cannot buy the actual S&P or DJI; this is due to both of these being an index or benchmark; however, as an alternative, you may. There is no annual fee for the BrokerageLink account. Through BrokerageLink, you have the ability to invest in ETFs, Fidelity mutual funds, and non-Fidelity. SPDRs, Vanguard, Schwab and Fidelity are just a few. Any of these ETF brands, and all the rest can be bought and sold at any brokerage. Free commission offer applies to online purchases of Fidelity ETFs in a Fidelity brokerage account with a minimum opening balance of $2, Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may. Automatic Investing for ETFs · Select the "Transact" icon · Tap "Recurring Transfers & Investments" · Select "Create," then follow the prompts. Fidelity ETF List ; Fidelity Enhanced Large Cap Growth ETF · FELG, Large Growth ; Fidelity High Dividend ETF · FDVV, Large Value. Look for Fidelity Canada ETFs traded through the TSX or Cboe exchanges, or Fidelity Canada series F mutual funds on your online brokerage account. Easily search. Ultimately, investors choosing an ETF need to ask 3 questions: What exposure does this ETF have? How well does the ETF deliver this exposure? And how. Explore what ETFs (exchange-traded funds) are, how they function, and ways to use them to help strengthen your investment portfolio. Neither mutual funds nor ETFs are perfect. Both can offer comprehensive exposure at minimal costs, and can be good tools for investors. ETFs can be traded at any time when the exchange it's listed on is open. Read more here about how you can invest in ETFs. How to Buy Fractional Shares on Fidelity · Step 1: Open a Fidelity Account · Step 2: Log in to Your Fidelity Account · Step 3: Click the “Trade” Tab · Step 4. Aims to provide large cap growth exposure by harnessing Fidelity's active management and fundamental research capabilities combining high conviction investment. Buy Fidelity ETFs with these platforms · Fidelity Blue Chip Value ETF (FBCV) · Fidelity Total Bond ETF (FBND) · Fidelity Low Volatility Factor ETF (FDLO) · Fidelity. An ETF (exchange-traded fund) is a basket of securities you can buy or sell through a brokerage firm on a stock exchange. Fidelity has offered investors 4 stock index mutual funds that do not charge management fees or, with limited exceptions, fund expenses. How to buy: The fund can be purchased directly from the fund company or through most online brokers. Vanguard S&P ETF (VOO). Overview: As its name suggests.

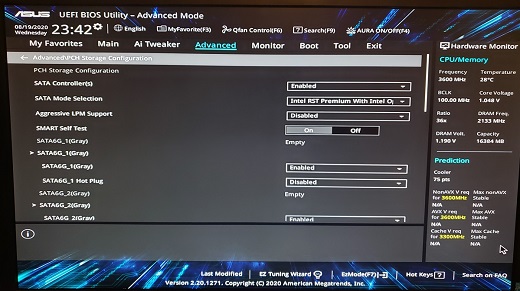

Nvme Raid Mode

3. Set “SATA Controller(s)” to. 4. Go to Advanced\AMD PBS and set “NVMe RAID mode”. Intel Virtual RAID on CPU (VROC) is a form of embedded software RAID that offers an enterprise RAID solution specifically designed for SATA/NVMe drives. The. I configure a RAID array like RAID 0 or RAID 1. No matter which RAID I choose, the RAID array evaporates when system reboots to install Windows 10 or Request Info. PCIe RAID controller increases performance and maximizes design flexibility with Tri-Mode connectivity and NVMe devices. Currently Viewing. If you find this useful, share the calculator! Raid Calculator v RAID Mode. An innovative NVMe switch chipset will deliver up to four channel connectivity via a PCIe x8 and x4 host interface. Integrated RAID 0, 1, & 10 is compatible. Please proceed to next step. •. If you are setting up an NVMe RAID set, go to Advanced > AMD PBS, then set. NVMe RAID mode to. 2 server backplanes to support hardware-based NVMe RAID solutions. There are already a few RAID controller cards on the market that support NVMe, but the market. NVMe drives are attached to the PCIe interface directly and do not have a dedicated hardware RAID engine similar to SAS controllers, therefore, RAID is only. 3. Set “SATA Controller(s)” to. 4. Go to Advanced\AMD PBS and set “NVMe RAID mode”. Intel Virtual RAID on CPU (VROC) is a form of embedded software RAID that offers an enterprise RAID solution specifically designed for SATA/NVMe drives. The. I configure a RAID array like RAID 0 or RAID 1. No matter which RAID I choose, the RAID array evaporates when system reboots to install Windows 10 or Request Info. PCIe RAID controller increases performance and maximizes design flexibility with Tri-Mode connectivity and NVMe devices. Currently Viewing. If you find this useful, share the calculator! Raid Calculator v RAID Mode. An innovative NVMe switch chipset will deliver up to four channel connectivity via a PCIe x8 and x4 host interface. Integrated RAID 0, 1, & 10 is compatible. Please proceed to next step. •. If you are setting up an NVMe RAID set, go to Advanced > AMD PBS, then set. NVMe RAID mode to. 2 server backplanes to support hardware-based NVMe RAID solutions. There are already a few RAID controller cards on the market that support NVMe, but the market. NVMe drives are attached to the PCIe interface directly and do not have a dedicated hardware RAID engine similar to SAS controllers, therefore, RAID is only.

TERRAMASTER D8 Hybrid HDD NVMe Enclosure USB Gen 2 10Gbps Type C 8Bay USB Storage Supports RAID 0/1/Single/JBOD Exclusive 2+6 RAID Hybrid Disk Array. Tri-mode RAID Controllers - NVME/SAS/SATA. The new fourth generation RAID controllers are tri-mode, which means they support NVME drives as well as SAS and SATA. NVMe command. 8. Over Provisioning may fail, even though Samsung Magician does not provide support for SSDs configured in RAID mode through the BIOS. Powerful functionality in a tiny package, with room for 10GbE and dual NVMe drives. RAID 1 to RAID 5; RAID 5 to RAID 6. Volume Expansion with Larger HDDs. Setting the NVMe PCIe SSDs to RAID mode · Turn on the system. · When the Dell Power-On Self-Test (POST) screen is displayed, press F2. · When the System Setup. SSD RAID (solid-state drive RAID) is a methodology commonly used to protect data by distributing redundant data blocks across multiple SSDs. Notes, These steps are only valid for Intel® Server Board SWFR and Intel® Server Board SST Product Family boards. This requires that BIOS Boot Mode. 2 NVME SSD Enclosure,Aluminum Dual Bay NVMe RAID SSD Case Support Max 16TB RAID0/1/PM Mode · JEYI Dual Nvme Enclosure, 2-Bay Hardware RAID Enclosure, 20Gbps. The only time I'd leave this enabled is if the laptop has an Intel Optane SSD, as RAID mode is needed for Optane to work properly. As a result, RAID mode will. (If you want to use NVMe PCIe SSDs to configure RAID, make sure to set NVMe RAID mode to. Enabled. Then set how the bandwidth of the PCIe slot you use is. RAID modes. Advanced Bootable NVMe RAID Technology. The SSD NVME RAID controller can be used to configure bootable RAID or single NVMe SSD configurations. There are a lot of misconception and some right information out there when it comes to the combination of solid state drives with RAID setups and what. An innovative NVMe switch chipset will deliver up to four channel connectivity via a PCIe x8 and x4 host interface. Integrated RAID 0, 1, & 10 is compatible. RAID 0 (Striping) - Also known as a “stripe” array, this mode delivers Maximum Performance and capacity by linking multiple NVMe SSD's together to act as a. “RAID”. Note: In order to secure erase NVMe drives, the 'Configure SATA as' option must be set to. 'AHCI' mode. Page 5. Press F10 to Save and Exit BIOS. Disabling remapping or changing RAID mode to AHCI to update firmware on NVMe SSDs will result in loss of data if the. NVMe SSDs were included in a RAID array. •. RAID 1 Mode: The RAID 1 mode of this external hard drive enclosure is for ensuring data safety. Two HDD's in the HDD enclosure can backup each other, and it can. PCIe RAID controller increases performance and maximize endless design flexibility with Tri-Mode connectivity and NVMe devices. SSD NVMe architechture is not designed for hardware RAID. SSD NVMe are installed on PCIe cards and not controlled by Storage controller, that is why SSD NVMe is.

5 Cash Back Credit Card Categories

Several banks offer credit cards that earn 5% cash back (or greater) across specific categories, rotating quarterly categories or at designated retailers. The best credit card bonus categories · Airfare purchases · Dining purchases · Cellular phone, internet, and cable purchases · Office supply store purchases · Food. Chase, Citi, Discover, US Bank and more offer cards that earn 5% cash back in rotating bonus categories. Here's how they stack up. Offer valid for cardholders issued new cashRewards credit card accounts. To be eligible for the $ cash back, you must make $3, or more in net purchases. Earn more cash back on the categories that mean the most: 5% on groceries Welcome offer: Get 5% Cash Back on eligible gas and grocery purchases for. Cash Back Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Double Cash® Card · Capital One. Here are three popular 5% cash-back cards and their bonus categories, to help you decide which card might be right for your lifestyle. Chase Freedom Flex®*: Best 5% cash-back card. U.S. Bank Shopper Cash Rewards® Visa Signature® Card *: Best for those who spend the most at select retailers. EARN 5% CASH BACK FROM CHASE ON UP TO $1, IN COMBINED PURCHASES · Gas Stations · EV Charging · Select Live Entertainment · Movie Theaters. Several banks offer credit cards that earn 5% cash back (or greater) across specific categories, rotating quarterly categories or at designated retailers. The best credit card bonus categories · Airfare purchases · Dining purchases · Cellular phone, internet, and cable purchases · Office supply store purchases · Food. Chase, Citi, Discover, US Bank and more offer cards that earn 5% cash back in rotating bonus categories. Here's how they stack up. Offer valid for cardholders issued new cashRewards credit card accounts. To be eligible for the $ cash back, you must make $3, or more in net purchases. Earn more cash back on the categories that mean the most: 5% on groceries Welcome offer: Get 5% Cash Back on eligible gas and grocery purchases for. Cash Back Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi Double Cash® Card · Capital One. Here are three popular 5% cash-back cards and their bonus categories, to help you decide which card might be right for your lifestyle. Chase Freedom Flex®*: Best 5% cash-back card. U.S. Bank Shopper Cash Rewards® Visa Signature® Card *: Best for those who spend the most at select retailers. EARN 5% CASH BACK FROM CHASE ON UP TO $1, IN COMBINED PURCHASES · Gas Stations · EV Charging · Select Live Entertainment · Movie Theaters.

A great alternative to the Chase and Discover cards, the Citi Custom Cash Card provides cardholders with a much simpler way to earn 5% cash back. You'll. Some Mastercard/Visa credit cards also offer 5% back in certain spending categories. In some cases, the 5% categories are fixed and do not. Here's why: The Chase Freedom Unlimited® is a great all-around cash back credit card. You'll find some generous cash back bonus categories. 5% on travel. Below chart gives you the 5% Cash Back Quarterly Categories for Chase Freedom, Discover It, and U.S. Bank Cash+, Citi Dividend, and more. 5% eligible categories: Restaurants, gas stations, grocery stores, select travel, select transit, select streaming services, drugstores, home improvement stores. I know I've heard of the Citi Custom Cash, Chase Freedom Flex and US Bank Cash+ as well as Discover It but are there any other 5% cards and which one is best? cash back on gas station purchases · cash back on dining purchases at restaurants · cash back on grocery store purchases · cash back on all other purchases. For your road trip, your everyday commuting and beyond, cash back on gas and electric vehicle charging station purchases can add up when you're on the go. Earn. These rotating categories will typically earn a higher rate than other purchases, while purchases that don't fall into these bonus categories are typically. Some Mastercard/Visa credit cards also offer 5% back in certain spending categories. In some cases, the 5% categories are fixed and do not. Earn up to 5% cash back in two categories you choose with the Cash+ Visa credit card. Learn more and apply today at U.S. Bank. With the Chase Freedom Flex(R) Credit Card, earn 5% cash back in bonus categories each quarter you activate, 5% cash back on travel purchased through Chase. Turn everyday purchases into unlimited cash back with a credit card rewards program. From grocery runs to gas fill-ups to dining out, whenever you use your Cash. Discover cash back credit cards let you earn cash back on every purchase, with a higher percentage of cash back in select categories. 3% cash back in the category of your choice, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. See below for details. The only credit cards that offer 5% cash back on everything are store credit cards, such as the Target Credit Card and the Kohl's Credit Card *, which can only. Cash-back credit cards come in three main types: flat rate, bonus rewards, and rotating category. There are also tiered cash-back credit cards, which give a different percentage of cash back on different categories of purchases, like groceries or gas. And. Most cards let you earn 1% to 6% back on eligible purchases. But read the fine print because card categories may have dollar limits and other restrictions. The only credit cards that offer 5% cash back on everything are store credit cards, such as the Target Credit Card and the Kohl's Credit Card *, which can only.

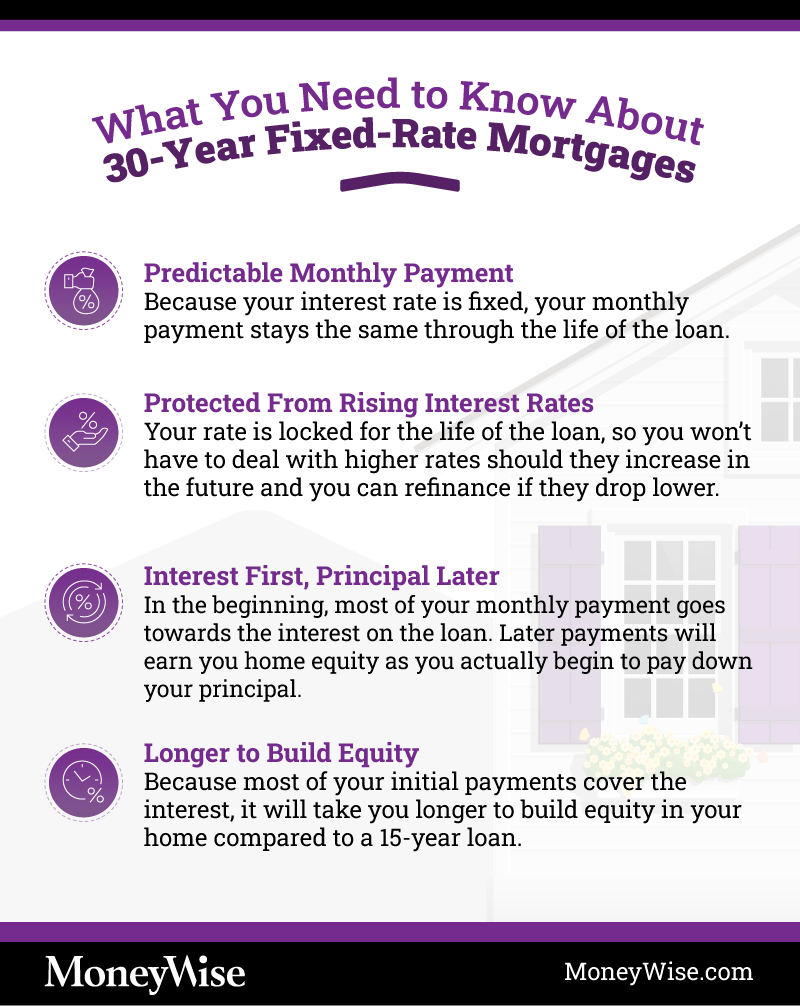

What Is The Best 30 Year Fixed Mortgage Rate

Explore current RBC mortgage rates, including fixed rates, variable rates, and special offers. On the week of August 29, , the current average interest rate for a year fixed-rate mortgage decreased 3 basis points from the prior week to %. The. As of August 30, , the best high-ratio, 5-year variable mortgage rate in Canada is %, which is available across Canada, including Ontario, Quebec. Get current 30 year mortgage rates and offers from loanDepot. We are a direct lender offering low 30 yr fixed rate home loans. See today's refi and purchase. year mortgage rates currently average % for purchase loans and % for refinance loans. Find your best mortgage rates · Get the lowest. A year fixed-rate mortgage is the most common mortgage loan option. It has a repayment period of 30 years and the interest rate doesn't change throughout the. Get the best rate by comparing 50+ quotes from mortgage providers in Canada. Getting quotes is just a click away with RATESDOTCA. Get your quote now! Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. We can tell you the best mortgage rates. Instantly get low rates for everything from 3-year fixed-rate mortgages to 5-year variable-rate mortgages. Explore current RBC mortgage rates, including fixed rates, variable rates, and special offers. On the week of August 29, , the current average interest rate for a year fixed-rate mortgage decreased 3 basis points from the prior week to %. The. As of August 30, , the best high-ratio, 5-year variable mortgage rate in Canada is %, which is available across Canada, including Ontario, Quebec. Get current 30 year mortgage rates and offers from loanDepot. We are a direct lender offering low 30 yr fixed rate home loans. See today's refi and purchase. year mortgage rates currently average % for purchase loans and % for refinance loans. Find your best mortgage rates · Get the lowest. A year fixed-rate mortgage is the most common mortgage loan option. It has a repayment period of 30 years and the interest rate doesn't change throughout the. Get the best rate by comparing 50+ quotes from mortgage providers in Canada. Getting quotes is just a click away with RATESDOTCA. Get your quote now! Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. We can tell you the best mortgage rates. Instantly get low rates for everything from 3-year fixed-rate mortgages to 5-year variable-rate mortgages.

Comparing current year mortgage rates ; LENDER. Navy Federal. INTEREST RATE, % ; Wells Fargo. % ; LENDER. Wells Fargo. INTEREST RATE, % ; Rocket. Of the fixed-rate mortgages, year terms generally have the highest interest rates and total interest costs, and the longer term builds equity more slowly. At the time of writing, the lowest year mortgage rate ever was % (according to Freddie Mac's weekly rate survey). That number may have changed since. And. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. On Friday, August 30, , the current average interest rate for a year fixed mortgage is %, down 11 basis points over the last seven days. For. Fannie Mae expects the average year fixed mortgage rate to trend slightly down between for Q3 and Q4 Fannie Mae forecasts the downward trend will. Today's competitive mortgage rates ; year · % · % · · $1, ; year · % · % · · $1, ; year · % · % · · $1, Mortgage rates today ; yr fixed · % · % · ($3,) ; yr fixed FHA · % · % · ($3,) ; yr fixed · % · % · ($3,). Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. year Fixed-Rate mortgages are among the most popular home loans available. They offer borrowers the security of stable, affordable monthly payments and. Our % 6-Mo Fixed is the lowest mortgage rate available in Canada. We've been happily giving our clients better rates, the easy way, for many (mortgage). The best year mortgage rates are usually lower than 4%, and the average mortgage rate nationally on a year fixed mortgage is % as of January As of Aug. 30, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. 30 year fixed, 8%. 30 Year Fixed Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · Currently, the average interest rate for a year fixed mortgage is at %. Last month, the average rate for year fixed mortgages was higher, at %. More house: Because applicants qualify based on their ability to make payments, a year fixed-rate loan allows you to pursue a more expensive house. Tax. A year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate throughout the course of the loan. The interest rate charged. Average Mortgage Rates, Daily ; 30 Year Fixed. %. % ; 20 Year Fixed. %. % ; 15 Year Fixed. %. % ; 10 Year Fixed. %. %. A year fixed-rate mortgage is a home loan with a repayment term of 30 years and an interest rate that remains the same throughout the life of the loan.

Can A Bank Go Bankrupt

A bank failure occurs when a bank is unable to meet its obligations to its depositors or other creditors because it has become insolvent or too illiquid to. Many of the small banks had lent large portions of their assets for stock market speculation and were virtually put out of business overnight when the market. Banks can become insolvent, for example, if they make risky investments and market conditions cause them to lose money, or if they lend to people or businesses. Although bankruptcy does not clear all debts, here are some examples of unsecured debts that go away: Bankruptcy will discharge most your unsecured debts, but. Banks can become insolvent, for example, if they make risky investments and market conditions cause them to lose money, or if they lend to people or businesses. And this decline in asset values relative to liabilities can lead to bank instability through two channels. First, a bank can become fundamentally insolvent if. A bank failure occurs when a bank is unable to meet its obligations to its depositors or other creditors because it has become insolvent or too illiquid to meet. If you open a new account before you're declared bankrupt, the official receiver will freeze your new account as well. The bank might also close the account. If. Discover answers to questions about CDIC's role in a financial institution or bank resolution (for instance, after a bank failure) by visiting our website. A bank failure occurs when a bank is unable to meet its obligations to its depositors or other creditors because it has become insolvent or too illiquid to. Many of the small banks had lent large portions of their assets for stock market speculation and were virtually put out of business overnight when the market. Banks can become insolvent, for example, if they make risky investments and market conditions cause them to lose money, or if they lend to people or businesses. Although bankruptcy does not clear all debts, here are some examples of unsecured debts that go away: Bankruptcy will discharge most your unsecured debts, but. Banks can become insolvent, for example, if they make risky investments and market conditions cause them to lose money, or if they lend to people or businesses. And this decline in asset values relative to liabilities can lead to bank instability through two channels. First, a bank can become fundamentally insolvent if. A bank failure occurs when a bank is unable to meet its obligations to its depositors or other creditors because it has become insolvent or too illiquid to meet. If you open a new account before you're declared bankrupt, the official receiver will freeze your new account as well. The bank might also close the account. If. Discover answers to questions about CDIC's role in a financial institution or bank resolution (for instance, after a bank failure) by visiting our website.

While no CDIC member has failed in over 20 years, it could happen again, and CDIC is here to reassure you that, should the unlikely occur, depositors won't lose. Most institutions use this opportunity to freeze the account, leaving clients without any funds going forward. However, both Bankruptcy and Consumer Proposals. Careful planning before filing for bankruptcy can make your case go more smoothly—and save you money. In some circumstances, stopping automatic payments and. The company can continue to operate, but financial decisions (like paying off creditors) must be approved by a bankruptcy court. You may be owed money by a. One of the smaller mostly/all online banks could go bankrupt though. Other banks will probably purchase the bank or parts of the bank. A bank failure is the closing of a bank by a federal or state regulator when the bank can't meet its obligations to depositors, borrowers, and others. Account holders who have uninsured deposits (that is, deposits over the amount insured by the FDIC) could ultimately recover all or a portion of those funds as. A bank run occurs when many customers simultaneously withdraw their money from deposit accounts for fear that the bank may be, or will become, insolvent. About Bankruptcy Filing bankruptcy can help a person by discarding debt or making a plan to repay debts. A bankruptcy case normally begins when the debtor. When a bank gives more money to its borrower than it owns in assets, it declares bankruptcy. Despite the legislative restrictions in place in. For a bank, being insolvent means it cannot repay its depositors, because its liabilities are greater than its assets. The effect that a bank has on the economy. Banks are regularly going bankrupt. Crises in the banking industry have occurred in three distinct time periods during the twentieth century—during the Great. January 29, , United States American Freedom Mortgage, Chapter 11 bankruptcy and liquidation ; February 21, , Northern Cyprus First Merchant Bank. A bank failure is defined as the closing of a bank by a federal or state banking regulatory agency. This typically happens when a bank is unable to meet its. Later that year, two investment banks became insolvent – Bear Stearns and Lehman Brothers. These failures sent shockwaves through financial markets and created. Most institutions use this opportunity to freeze the account, leaving clients without any funds going forward. However, both Bankruptcy and Consumer Proposals. Although bankruptcy can provide relief if you are unable to repay your debts, there are consequences which may affect you. When does a bank go into resolution? As a rule, all banks can go bankrupt, just like any other business. But not if the impact on the economy, financial. A bank can refuse to offer you overdraft protection on your account, if you are or have been bankrupt. This makes sense, since overdraft really is a form of. Many major banks have proven to be willing to continue doing business with clients even if they have declared bankruptcy while owing them a debt. However, just.

Fastest Way To Eliminate Credit Card Debt

3. Pay more than the minimum · Reducing your debt more quickly. Paying more can help cover interest charges and decrease the total balance on your credit card. It can help if you show your lender what you can and cannot afford to pay. You can do this by sharing a budget that shows how much money you: Have coming in. Go to a good local credit union. (I've also heard fidelity can be helpful). Ask them for help consolidating and paying down your credit cards. When you take out a debt consolidation loan, you use the proceeds to pay off all your credit card debt. Then, instead of making payments to several creditors. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at. Reduce or eliminate interest charges, so you can focus on eliminating principal (the actual debt you owe) · Finding monthly payments that work for your budget. How Should I Negotiate With Credit Card Companies to Reduce Debt? The easiest way to negotiate with a credit card company is by calling their main phone. 3. Pay more than the minimum · Reducing your debt more quickly. Paying more can help cover interest charges and decrease the total balance on your credit card. Trying to eliminate all of your debt? Keeping credit accounts open, and paying the balances in full every month, may help you maintain or increase your credit. 3. Pay more than the minimum · Reducing your debt more quickly. Paying more can help cover interest charges and decrease the total balance on your credit card. It can help if you show your lender what you can and cannot afford to pay. You can do this by sharing a budget that shows how much money you: Have coming in. Go to a good local credit union. (I've also heard fidelity can be helpful). Ask them for help consolidating and paying down your credit cards. When you take out a debt consolidation loan, you use the proceeds to pay off all your credit card debt. Then, instead of making payments to several creditors. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at. Reduce or eliminate interest charges, so you can focus on eliminating principal (the actual debt you owe) · Finding monthly payments that work for your budget. How Should I Negotiate With Credit Card Companies to Reduce Debt? The easiest way to negotiate with a credit card company is by calling their main phone. 3. Pay more than the minimum · Reducing your debt more quickly. Paying more can help cover interest charges and decrease the total balance on your credit card. Trying to eliminate all of your debt? Keeping credit accounts open, and paying the balances in full every month, may help you maintain or increase your credit.

Debt consolidation works on same principal as debt reduction. You reduce or eliminate interest charges, so you can focus on quickly paying down principal. But. 8 Tips to Manage and Reduce Credit Card Debt · 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card. 1. Understand Your Debt · 2. Plan a Repayment Strategy · 3. Understand Your Credit History · 4. Make Adjustments to Debt · 5. Increase Payments · 6. Reduce Expenses. Use financial windfalls. Commit raises, bonuses or other financial windfalls to debt reduction rather than adding these funds to your monthly spending pool. A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials. Go to a good local credit union. (I've also heard fidelity can be helpful). Ask them for help consolidating and paying down your credit cards. Reduce or eliminate interest charges, so you can focus on eliminating principal (the actual debt you owe) · Finding monthly payments that work for your budget. 1. Contact your credit card companies · 2. Understand the two ways to pay off credit card debt · 3. Consider a debt management plan · 4. Participate in credit. How can I pay off my credit card debt? · Lower or pause your payments to see if your finances get better · Pause or lower interest and other charges on your. Credit Card Debt · Pay more than the minimum required. · Make an extra payment during the month. · Ask for a lower APR. · If you are having a hard time making your. How to Get Out of Debt Fast · Add Up All Your Debt · Adjust Your Budget · Use a Debt Repayment Strategy · Look for Additional Income · Consider Credit Counseling. 1. Take account of your accounts · 2. Check your credit report · 3. Look for opportunities to consolidate · 4. Be honest about your spending · 5. Determine how much. One of the quickest ways to get rid of debt fast is by using the “debt snowball” approach. Debt Repayment – Doing the Math | sftupak.ru This strategy calls for. How to pay off credit cards in 7 steps · 1. Stop using your credit cards. · 2. Get a realistic fix on your debt. · 3. Begin the month with a budget. · 4. Make. The snowball method targets the credit card that has the smallest current balance. While you assign the minimum payment to all other credit cards, you use every. The best way to pay down credit cards is to start with the lowest balance and work your way up. However, there are other tactics you can take as well. How to get rid of your credit card debt · If you're in a bind, talk to your credit card issuer · Identify the cause of your credit card debt · Choose a payoff. If high interest rates are in the way, transfer your balance to a card with a lower rate at another financial institution. A balance transfer can also help with. 1: Cut up the cards. Stop charging purchases, use cash or debit. · 2: Pay more than minimum to just one CC company. this pays that card off early. If high interest rates are in the way, transfer your balance to a card with a lower rate at another financial institution. A balance transfer can also help with.

Short Sell Stock

Short selling is the selling of a stock that the seller doesn't own. More specifically, a short sale is the sale of a security that isn't owned by the seller. Short selling refers to borrowing stocks (usually from your broker) so as to sell them at the prevailing market prices, with the hope of buying them at a. The short seller borrows shares and immediately sells them. The short seller then expects the price to decrease, after which the seller can profit by purchasing. Short Sale Constraints. To be able to sell a stock short, one must borrow it, and because borrowing shares is not done in a centralized market, finding. In its simplest form, short selling is selling shares that you don't own. A stockbroker will first loan you shares that you can sell. When you sell short and. Buying stocks on a Long Position is the action of purchasing shares of stock(s) anticipating the stock's value will rise over time. The short seller's profit is the difference in price between when the investor borrowed the stock and when they returned it. How to short a stock · Apply and qualify for a margin account with your brokerage. · Next, apply and qualify to add short selling to your margin account. A "short" position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. If the price. Short selling is the selling of a stock that the seller doesn't own. More specifically, a short sale is the sale of a security that isn't owned by the seller. Short selling refers to borrowing stocks (usually from your broker) so as to sell them at the prevailing market prices, with the hope of buying them at a. The short seller borrows shares and immediately sells them. The short seller then expects the price to decrease, after which the seller can profit by purchasing. Short Sale Constraints. To be able to sell a stock short, one must borrow it, and because borrowing shares is not done in a centralized market, finding. In its simplest form, short selling is selling shares that you don't own. A stockbroker will first loan you shares that you can sell. When you sell short and. Buying stocks on a Long Position is the action of purchasing shares of stock(s) anticipating the stock's value will rise over time. The short seller's profit is the difference in price between when the investor borrowed the stock and when they returned it. How to short a stock · Apply and qualify for a margin account with your brokerage. · Next, apply and qualify to add short selling to your margin account. A "short" position is generally the sale of a stock you do not own. Investors who sell short believe the price of the stock will decrease in value. If the price.

Shorting a stock is a way for investors to bet that a particular stock's future share price will be lower than its current price. Shorting stocks outright, or via short call or long put options gives you exposure based on your speculation that the market will go down. Short sale trade data is publicly available for off-exchange (OTC) trades in exchange-listed securities reported to a FINRA Trade Reporting Facility (TRF). Short selling is a regulated and widely used strategy. Investors use short selling when they believe, based on fundamental research, that a stock price is. To short-sell a stock, you borrow shares from your brokerage firm, sell them on the open market and, if the share price declines as hoped and anticipated, buy. Summary If you want to practice short selling-stocks in a risk-free environment, you can open a demo account with IG and start testing your CFD trading, and. Short selling is an investment strategy when an investor expects that value on a stock to go down. Its extremely high-risk since investors are borrowing stocks. A short sale generally involves the sale of a stock you do not own (or that you will borrow for delivery). Short sellers believe the price of the stock will. In order to sell short, the investor must borrow shares from their broker. This involves risk, because they are required to return the shares at some point in. Short selling is—in short—when you bet against a stock. You first borrow shares of stock from a lender, sell the borrowed stock, and then buy back the shares. What is short selling? Quite simply, short selling is selling a stock that you don't already own. There are rules in place to require a stock to. The traditional method of shorting stocks involves borrowing shares from someone who already owns them and selling them at the current market price – if there. Most Shorted Stocks ; RILY. RILY. B. Riley Financial Inc. $, %. % ; DGLY. DGLY. Digital Ally Inc. $, %. %. Short selling requires the borrowing of stock from a broker, with a shared agreement that the stock will be replaced by the time of settlement. The investor. Selling stock short means borrowing stock through the brokerage firm and selling it at the current market price, which the short seller believes is due for a. To understand what short interest is, we should first talk about short sales. Put simply, a short sale involves the sale of a stock an investor does not own. Short selling, also known as 'going short' or 'shorting' is a trading strategy that speculates on the price decrease of a stock or other security. Short selling involves the sale of borrowed stock. Short selling flips the typical investing pattern of buy low, sell high. How to short a stock · Apply and qualify for a margin account with your brokerage. · Next, apply and qualify to add short selling to your margin account. Short selling is the practice of selling borrowed securities – such as stocks – hoping to be able to make a profit by buying them back at a price lower than.

Nas100 Traders

The Nasdaq index includes companies from a broad range of industries with the exception of those that operate in the financial industry, such as banks. Nasdaq 's main difference from other indices such as S&P and Dow Jones is that it mainly consists of stocks of the technology sector (%). That's why. 6 Best Nasdaq Brokers rated and reviewed. An overview of the brokers that made this list with their pros & cons for traders. See market data and sentiment and spot trading opportunities for IG's US Tech stock index - settled on the price of the NASDAQ. Trader Talk · Tech · Cybersecurity · Enterprise · Internet · Media · Mobile · Social Media Best Free Stock Trading Platforms · Best Robo-Advisors · Index. What is Nasdaq Cash CFD / NAS? The standard contract size for NAS is 1 with max lots of tradeable in lot increments. Nas Index, Stock & Forex traders. Best Trading Community Let's talk about index, stock, crypto, Forex, metals and other investment instruments. Stock indices give you a chance to trade an opinion of an economy without having to pick individual stocks. With unique benefits to both CFD trading and spread. View live US Cash CFD chart to track latest price changes. FX:NAS trade ideas, forecasts and market news are at your disposal as well. The Nasdaq index includes companies from a broad range of industries with the exception of those that operate in the financial industry, such as banks. Nasdaq 's main difference from other indices such as S&P and Dow Jones is that it mainly consists of stocks of the technology sector (%). That's why. 6 Best Nasdaq Brokers rated and reviewed. An overview of the brokers that made this list with their pros & cons for traders. See market data and sentiment and spot trading opportunities for IG's US Tech stock index - settled on the price of the NASDAQ. Trader Talk · Tech · Cybersecurity · Enterprise · Internet · Media · Mobile · Social Media Best Free Stock Trading Platforms · Best Robo-Advisors · Index. What is Nasdaq Cash CFD / NAS? The standard contract size for NAS is 1 with max lots of tradeable in lot increments. Nas Index, Stock & Forex traders. Best Trading Community Let's talk about index, stock, crypto, Forex, metals and other investment instruments. Stock indices give you a chance to trade an opinion of an economy without having to pick individual stocks. With unique benefits to both CFD trading and spread. View live US Cash CFD chart to track latest price changes. FX:NAS trade ideas, forecasts and market news are at your disposal as well.

Trading NAS through CFDs allows traders to speculate on the price movements of the NAS index without owning the actual underlying stocks. When one trades. The US Tech can be traded within regular NASDAQ trading hours. At sftupak.ru, you can trade the US Tech CFDs on Monday to Wednesday to and. What is the price of NAS? Live NAS price quote, price chart, daily, weekly, monthly and yearly trading ranges. Top US Tech Trading Brokers · 1. Fusion Markets. Min Deposit. $0. Fees · 2. AvaTrade. Min Deposit. $ Fees · 3. eToro. Min Deposit. starts from $ Fees. Learn How To Trade Nas and US30 Professionally. In this course you will learn the 95% winning strategy to trade Nas and US30 professionally. Scalping the NASDAQ is most effective when market conditions are highly volatile, liquidity is ample, and spreads are tight. Traders who choose this. The NAS Index contains the largest non-financial companies by market capitalisation that are publicly traded on the NASDAQ Stock Exchange. E-Mini Nasdaq Index Futures Contract Specifications. The E-mini Nasdaq index futures contracts are standardized exchange-traded contracts that represent. NASDAQ INDEX Trading signals: automatic detection of technical indicator configurations, chart patterns and candlesticks. US_Tech, Based on NASDAQ Trading information · The US_Tech price moves in increments of · The minimum trade size is 1 unit · The currency of the. View Nasdaq index pricing chart, leverage info, latest research and price drivers. Trade the US Tech index at sftupak.ru NAS is the shortening of NASDAQ , a leading US stock index comprised of of the largest non-financial companies listed on the NASDAQ exchange. Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays. All Text Fields Are Required. Check the NAS live exchange rate, read trading ideas and related news for today, and learn about the Octa trading conditions on MetaTrader 4. Any broker will do. and the symbol is QQQ the largest non-financial stocks on the NASDAQ EXCHANGE. All stock brokers can handle this trade. E-mini Nasdaq futures represent 20 times the Nasdaq stock index and allows you to participate in Nasdaq market moves without having to select individual. Upgrade your trading knowledge. Learn how to navigate the indices market with our Academy. How to use the Relative Vigor Index in trading. With the US tech CFD, you may trade the Index of technology stocks on a daily basis without having to purchase the underlying equities. Is NAS and US. Resumption Trade Time. 08/23/, , BCAN, Femto Technologies Inc. Cm St, NASDAQ. T1. 08/23/, , OBLG, Oblong Inc. Common Stock, NASDAQ. T1. OANDA Trade · OANDA Trade Demo. Instruments keyboard_arrow_right. arrow_back NAS/USD. US Nas Q4 Outlook. After maintaining an upward.

How Much Does It Cost To Get Furnace Serviced

A service call will typically run between $ and $ Whether you need a new furnace or repair your old one, you'll have to pay the technician for their time. Some companies use tune-ups to spot needed (and sometimes unnecessary) repairs; make sure that any additional work will not be performed automatically only if. Most homeowners spend between $ and $ If you have an electric furnace, expect to pay around $ The cost of gas furnace repair can. A furnace maintenance tune-up has several benefits: Ensures peak efficiency of your furnace; Saves heating costs by ensuring top efficiency; Decreases risk of. How often should I be getting furnace maintenance services? Generally, it is recommended to get professional furnace maintenance services at least once a year. Why Have Your Furnace Serviced? Many people overlook their furnace until it fails, yet an annual tune-up can significantly extend its lifespan. A neglected. The average cost of AC repair can range from $ to $1, or more. Several factors affect the cost, including the type of repair needed. A furnace inspection costs around $, though the price varies from one HVAC company to the next. Comparatively, its cost is less than most all furnace repairs. How often should you get a furnace tuned up? Most HVAC specialists recommend annual furnace maintenance visits prior to each heating season. Units that receive. A service call will typically run between $ and $ Whether you need a new furnace or repair your old one, you'll have to pay the technician for their time. Some companies use tune-ups to spot needed (and sometimes unnecessary) repairs; make sure that any additional work will not be performed automatically only if. Most homeowners spend between $ and $ If you have an electric furnace, expect to pay around $ The cost of gas furnace repair can. A furnace maintenance tune-up has several benefits: Ensures peak efficiency of your furnace; Saves heating costs by ensuring top efficiency; Decreases risk of. How often should I be getting furnace maintenance services? Generally, it is recommended to get professional furnace maintenance services at least once a year. Why Have Your Furnace Serviced? Many people overlook their furnace until it fails, yet an annual tune-up can significantly extend its lifespan. A neglected. The average cost of AC repair can range from $ to $1, or more. Several factors affect the cost, including the type of repair needed. A furnace inspection costs around $, though the price varies from one HVAC company to the next. Comparatively, its cost is less than most all furnace repairs. How often should you get a furnace tuned up? Most HVAC specialists recommend annual furnace maintenance visits prior to each heating season. Units that receive.

Edison Heating & Cooling recommends a short, preventative maintenance visit with an HVAC technician around once a year; typically, at the end of summer. We'll. You should have your furnace professionally maintained at least once every year. Is furnace maintenance necessary if I'm not experiencing issues? Yes, furnace. What Is Included In An Annual Maintenance Service? An annual maintenance plan is usually offered to you when you purchase a furnace and install it in your home. The contractors you hire to repair your furnace determines how much it'll cost. Service fees range from $50 to $, depending on the contractor. This service. The average cost is around $ Capacitor replacement: A common AC problem, a capacitor replacement will typically run between $90 and $, depending on. An average furnace tune-up or servicing costs $ to $ in Edmonton. Depending on what service your furnace needs, the cost varies by the type of furnace. How often should the furnace be serviced? As a rule of thumb, you should have maintenance performed on your home's furnace once every year. If your furnace is. $ No-Breakdown Maintenance Tune-Up For Furnaces -Book Today · Our licensed and trained technician will come to your home · Provide a Comprehensive Tune-Up on. sftupak.ru Much Does Furnace Maintenance Cost? Naperville area heating and cooling companies typically charge between $ and $ for routine furnace maintenance. While most electric furnaces will take about $ or less to repair, gas furnace repairs range from $ to $1, In terms of service charges, most HVAC. What Does Furnace Maintenance Cost? Quality Comfort Home Services knows that when it comes to home comfort in the winter, you rely on your furnace. That's why. In order to keep your furnace working properly, you need to have it regularly cleaned. The cost of furnace cleaning can range between $75 to $ and is subject. You'll pay anywhere from $50 to $ per hour for repairs plus any materials and replacement parts. How often should you have your furnace cleaned? You should. Why Should You Get a Furnace Maintenance Tune-Up in Indianapolis, IN? · Ensures peak efficiency of your furnace · Saves heating costs by ensuring top efficiency. In April the cost to Clean Furnace starts at $ - $ per furnace. Use our Cost Calculator for cost estimate examples customized to the location, size. You should have your furnace professionally maintained at least once every year. Is furnace maintenance necessary if I'm not experiencing issues? Yes, furnace. While most electric furnaces will take about $ or less to repair, gas furnace repairs range from $ to $1, In terms of service charges, most HVAC. The average cost of furnace repair services is between $ and $, depending on the problem. On the low end, homeowners pay around $90 for a service call and. Edison Heating & Cooling recommends a short, preventative maintenance visit with an HVAC technician around once a year; typically, at the end of summer. We'll. How Much Does it Cost to Get a Furnace Inspected? A furnace check up costs an average of $80 to $, but more if repairs are also needed. Service contracts or.